The new rates lifted the 32.5% rate ceiling from $87,000 to $90,000 in the 4 years from 1 July 2018 to 30 June 2022, with further adjustments scheduled from 1 July 20.

The 2018 Budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 July 2018 through to 1 July 2024. A Medicare Levy Surcharge may also be applicable and is applied on a progressive basis if eligible private health insurance cover is not maintained.

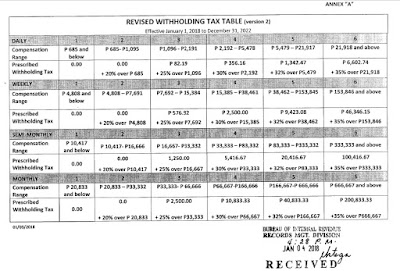

#Tax tables 2020 full

There are low income and other full or partial Medicare exemptions available. The above tables do not include Medicare Levy or the effect of Low Income Tax Offset (“LITO”) or LMITO.

.png)

$51,667 plus 45c for each $1 over $180,000įor a free tax calculator (with download link) click here This tax table reflects the tax scale applying from 1 July 2020 to 30 June 2021 for the ATO’s 2021 personal individual tax rates.

0 kommentar(er)

0 kommentar(er)